NEW YORK, Nov. 17, 2021 /PRNewswire/ — Bit Digital, Inc. (Nasdaq: BTBT) (“Bit Digital” or the “Company”), a bitcoin mining company headquartered in New York, announced its unaudited bitcoin production and mining operations update for the third quarter ended September 30, 2021.

Preliminary Third Quarter 2021 Highlights

- We completed our fleet’s exit from China. As of the date of this press release, 100% of our fleet had arrived in North America. As of September 30, 2021, we had no miners remaining in China: 79.1% of our miner fleet was already deployed or awaiting installation in North America, and 20.9% was in transit.

- The Company owned 27,744 miners as of September 30, 2021, with an estimated maximum total hash rate of 1.603 Exahash (“EH/s”). The 0.318 EH/s reduction in the third quarter was due to fleet repositioning, in which the Company sold or disposed of certain models (partially offset by purchases) in anticipation of purchase opportunities. The Company recognized a $0.375 million gain on miner sales, and the net sale proceeds had been reinvested into miner purchases as of the date of this press release.

- The Company purchased 851 miners on the spot market during the quarter.

- Subsequent to September 30, 2021, the Company signed an agreement with Bitmain Technologies Limited (“Bitmain”) to purchase 10,000 Bitcoin miners. The previously announced purchases are expected to increase Bit Digital’s maximum hash rate by approximately 1.0 EH/s. Pro forma for the announced purchases, our maximum total hash rate is expected to be approximately 2.603 EH/s.

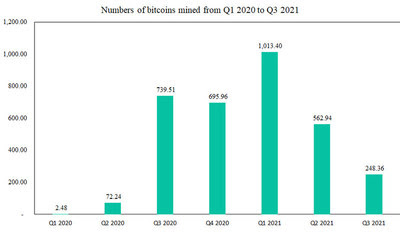

- The Company earned 248.36 bitcoins. The reduction from the second quarter was due to the migration program, in which a higher percentage of fleet capacity was offline while in transit to, or awaiting installation in, North America, as well as miner sales and disposals.

- Treasury holdings of BTC and WBTC were 526.1 and 101.0, respectively, for a total of 627.1 BTC equivalent, with a fair market value of approximately $27.5 million as of September 30, 2021.

- The Company raised $80 million of gross proceeds in a private placement with institutional investors.

- The Company announced that Brock Pierce, Chairman of the Bitcoin Foundation, joined its Board of Directors effective October 31, 2021.

Miner Migration Completed

As a result of the State Council targeting virtual currency mining in China, we terminated all mining operations in China on June 21, 2021. Accordingly, we further accelerated our migration strategy to North America, that had been ongoing since October 2020, and completed our fleet’s exit from China during the third quarter. As of September 30, 2021, we had no miners in China: 79.1% of our fleet was already deployed or awaiting installation in North America, and 20.9% was in transit. As of the date of this press release, 100% of our fleet had arrived in North America.

Power and Hosting Update

During the third quarter, the Company signed two new hosting agreements in the United States, representing 135 megawatts (“MW”) of additional power capacity. Both are expected to be powered by a substantial component of renewable and/or carbon-free energy, contributing to our ongoing efforts to decarbonize our mining operations.

On July 22, we signed a 100 MW agreement with Digihost Technologies (“Digihost”) that is expected to be powered by approximately half renewable and/or carbon free energy sources, subject to finalizing our energy procurement strategy with Digihost. This second agreement brings our total contracted hosting capacity with Digihost to 120 MW. Digihost is expected to deliver the first 20 MW of contracted power capacity during Q4 2021. The remaining 100 MW is scheduled for delivery during the first and second quarters of 2022.

On August 25, we signed a 35 MW hosting agreement with Blockfusion USA (“Blockfusion”) that is expected to be powered primarily from zero carbon emission energy sources. As of the date of this press release, Blockfusion had completed the first (of four) phases of miner deployments, representing approximately 5 MW of power consumption. The remaining three phases are scheduled for delivery in Q4 2021 and Q1 2022. During the term of our agreement and for twelve (12) months thereafter, Bit Digital has a right of first refusal to match any bona fide offer from a third party to finance or acquire securities and/or assets of Blockfusion, and to receive a credit or refund of certain expenses incurred in the development of infrastructure.

As a result of these two new agreements, as of September 30, 2021, the Company had secured hosting capacity sufficient to complete the redeployment of its fleet in North America, with additional signed capacity to facilitate future fleet growth. The Company continues to evaluate additional hosting arrangements with existing and prospective new hosting partners.

Our hosting partner Compute North LLC (“Compute North”) has advised us that its delivery of 40 MW of hosting capacity that was contracted for during Q2 and anticipated for delivery in Q3 2021 has been delayed. Compute North has not yet determined updated delivery timing for this additional capacity. Pending revised delivery timing, Bit Digital expects to redirect miner deployments to other hosting partners.

Our hosting partner Link Global Technologies (“Link”) has advised us that Link’s facility in Alberta, Canada that had supplied approximately 3.3 MW for hosting our miners was required to discontinue operations as a result of a permitting dispute. Link is currently evaluating alternative sites to accommodate our miners. In the interim, pending further updates, Bit Digital expects to redirect miners formerly hosted with Link to other hosting partners.

The following table summarizes our signed hosting agreements as of September 30, 2021, and expected delivery timing based on communications with our hosting partners:

| Hosting Partner |

Date

Signed |

Location

(State) |

Expected

Power

Capacity

(MW) |

% of

Total |

Expected

Delivery

Timing |

| Compute North

|

9/9/2020 |

Texas |

0.3 |

0.1% |

Delivered |

Link Global

Technologies

|

1/31/2021 |

TBD

(formerly Alberta) |

3.3 |

1.5% |

TBD

|

| Compute North

|

12/30/2020 |

Nebraska |

6.5 |

3.0% |

Delivered |

| Compute North

|

1/21/2021 |

Nebraska |

9.2 |

4.3% |

Delivered |

| Other

|

2/22/2021 |

Georgia |

0.3 |

0.2% |

Delivered |

| Compute North

|

3/12/2021 |

TBD |

40.0 |

18.6% |

TBD |

Digihost

Technologies

|

6/10/2021 |

New York |

20.0 |

9.3% |

Q4 2021

|

Digihost

Technologies

|

7/22/2021 |

New York |

100.0 |

46.6% |

Q1 to Q2 2022 |

| Blockfusion USA |

8/25/2021 |

New York |

35.0 |

16.3% |

Q4 2021 to Q1

2022 (1) |

| Total |

|

|

214.6 |

100.0% |

|

|

| (1) Approximately 5 MW has already been delivered as of the date of this press release. |

The following table summarizes our expected hosting deliveries, by quarter:

| Expected Delivery Timing |

Expected Power Capacity (MW) |

| Delivered as of September 30, 2021 |

21.3 |

| Q4 2021 |

30.0 |

| Q1 2022 |

80.0 |

| Q2 2022 |

40.0 |

| To be determined |

43.3 |

| Total |

214.6 |

Pro forma for hosting agreements signed to date, we expect to enjoy a competitive estimated base power and hosting rate of approximately 3.6 cents per kilowatt-hour, on an annualized weighted average basis.The foregoing base power rate therefore is an estimate and relies on certain assumptions, including but not limited to estimated future energy procurement pricing, and excludes the effect of profit sharing arrangements. We achieve what we believe are attractive hosting rates, in part, by offering profit shares to many of our hosting partners. We believe that profit sharing helps align interests with our hosts, and contributes to strong performance and uptime for our hosted miners.

Bitcoin Production Update

In the third quarter of 2021, Bit Digital earned 248.4 newly minted bitcoins, a reduction from 588.4 earned in the second quarter. The reduction was due to the aforementioned miner migration, as well as fleet repositioning in which the Company sold or disposed of certain miners. Bitcoin production is expected to increase following completion of the redeployment of miners migrated from China, which is expected during the first quarter of 2022, and upon completion of announced miner purchases.

The Company’s quarterly bitcoin production since commencement of our mining operations was as follows:

Miner Fleet Update

As of September 30, 2021, the Company owned 27,744 miners, with an estimated total maximum hash rate of 1.603 EH/s, a decrease from 32,500 miners and 1.915 EH/s as of June 30, 2021. The reduction was due to sales and disposals of certain miners, partially offset by miner purchases, as further discussed below. The Company’s fleet of owned miners comprised the following models:

| Model |

Owned as of

September 30, 2021 |

| MicroBT Whatsminer M21S |

16,296 |

| MicroBT Whatsminer M20S |

3,690 |

| Bitmain Antminer S17 |

3,641 |

| MicroBT Whatsminer M10 |

1,938 |

| Bitmain Antminer T3 |

769 |

| Bitmain Antminer S19 Pro |

605 |

| Bitmain Antminer S17+ |

500 |

| MicroBT Whatsminer M30S |

261 |

| Bitmain Antminer T17+ |

44 |

| Total |

27,744 |

Miner Purchases, Sales and Disposals

During the third quarter, we purchased 851 miners on the spot market, including 400 Bitmain S19Pro and 451 Bitmain S17 models. As of September 30, 2021, all of the newly purchased miners had already been deployed in North America.

Subsequent to September 30, 2021, we signed an agreement with Bitmain to purchase 10,000 Bitcoin miners. The total maximum purchase price is estimated at US $65,000,000 (subject to certain potential discounts), of which the initial installments have been made, with the final installment due ten (10) days prior to each shipment through June 2022. The announced purchases are expected to increase Bit Digital’s miner fleet hash rate by approximately 1.0 EH/s. Pro forma for announced purchases, our maximum total hash rate is expected to be approximately 2.603 EH/s.

The Company anticipates an ongoing opportunity to purchase additional miners, both on the spot market and from manufacturers in the coming months, subject to market conditions and capital availability, and continues to monitor market conditions for such purchase opportunities.

During the quarter, we continued repositioning our fleet by selling 4,200 miners that were deemed to have a lower expected return on invested capital than miners we believe we can purchase, and/or were deemed unsuitable for long-distance migration to North America. The sold miners included 4,000 Bitmain S17 and 200 Bitmain T17 models. The Company recorded a gain of $0.375 million on these sales, in aggregate. The net sale proceeds had been reinvested into miner purchases and/or purchase orders as of the date of this press release.

During the quarter, we abandoned 1,407 miners that were deemed to have reached the end of their useful lives, were no longer operational and/or would have been uneconomical or impossible to repair or migrate. The disposed miners included 611 Bitmain S17+, 301 MicroBT M21S, 252 MicroBT M10, 212 Bitmain T17+ and 31 Bitmain T3 models.

Private Placement Transaction with Institutional Investors

On October 5, 2021, the Company closed its previously announced private placement with institutional investors for the sale of 13,490,728 ordinary shares. The Company also issued to the investors unregistered warrants to purchase up to an aggregate of 10,118,046 ordinary shares. The gross proceeds from the private placement were approximately $80 million before deducting placement agent fees and other estimated offering expenses.

Appointment of Director

On September 28, 2021, the Company announced the appointment of Brock Pierce, Chairman of the Bitcoin Foundation, to its board of directors. Such appointment became effective on October 31, 2021.

Management Commentary

“Bit Digital marks a major milestone for our Company. Our mining assets are now entirely out of China and 100% in North America,” said Bryan Bullett, Bit Digital’s CEO. “It’s unusual that a business is faced with migrating the majority of its operating assets across the globe on an expedited timeline. Thanks to our talented team, partners, and head start, having begun migrating in October 2020, we accomplished a major logistical feat. I’d like to thank the entire Bit Digital team for exceptional performance in executing against these unprecedented circumstances.”

“It’s also unusual that a major economy exits an entire vertical, as China did earlier this year, by banning bitcoin mining. Despite the initial operational complexity – a challenge our team squarely met – we believe the shift in global hash distribution will result in a stronger bitcoin network, with the majority of hash now located here in North America.”

“By closing our recent $80 million equity placement, we illustrated our access to growth capital, and welcomed new institutional shareholders. We thank these institutions for trusting us with their investment.”

“We committed the majority of the placement’s net proceeds within approximately one week, securing 10,000 new Bitmain units on what we believe are attractive terms. And while the accelerated migration prompted us to modestly cull our legacy fleet, we expect this to result in improved profitability, as our purchase activity significantly exceeded the temporary reduction in fleet size since the start of Q3. Pro forma for announced purchases, we expect to have approximately 2.6 EH/s of mining power.”

“Finally, we welcomed to our Board of Directors Brock Pierce, a legendary crypto pioneer who needs no introduction. We believe that with his newly elevated position in the Company, Brock’s vast industry knowledge, relationships, and guidance will be invaluable going forward.”

About Bit Digital

Bit Digital, Inc. is a bitcoin mining company headquartered in New York City. Our mining operations are located in North America. For additional information, please contact Sam Tabar at sam@bit-digital.com or visit our www.bit-digital.com.

Investor Notice

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward-looking statements described under “Risk Factors” in Item 3.D of our most recent Annual Report on Form 20-F for the fiscal year ended December 31, 2020. If any material risk was to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Future changes in the network-wide mining difficulty rate or Bitcoin hash rate may also materially affect the future performance of Bit Digital’s production of bitcoin. Additionally, all discussions of financial metrics assume mining difficulty rates as of September 2021. See “Safe Harbor Statement” below.

Safe Harbor Statement

This press release may contain certain “forward-looking statements” relating to the business of Bit Digital, Inc., and its subsidiary companies. All statements, other than statements of historical fact included herein are “forward-looking statements.” These forward-looking statements are often identified by the use of forward-looking terminology such as “believes,” “expects,” or similar expressions, involving known and unknown risks and uncertainties. Although the company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website at http://www.sec.gov. All forward-looking statements attributable to the company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the company does not assume a duty to update these forward-looking statements.

| Note: Actual operating hash rate will vary depending on network difficulty rate, total hash rate of the network, the operations of our facilities and the status of our miners. |

Photo – https://mma.prnewswire.com/media/1690324/image.jpg

Logo – https://mma.prnewswire.com/media/1314923/Company_Logo.jpg